When it comes to protecting your family’s future, even small estate planning mistakes can have devastating financial consequences. After more than 30 years of practicing estate planning law in Texas, I’ve seen families lose tens of thousands of dollars—and irreplaceable peace of mind—due to easily preventable errors.

Whether you’re in Waco, Round Rock, or anywhere in Texas, understanding these common pitfalls can help you avoid costly probate fees, family disputes, and unnecessary tax burdens.

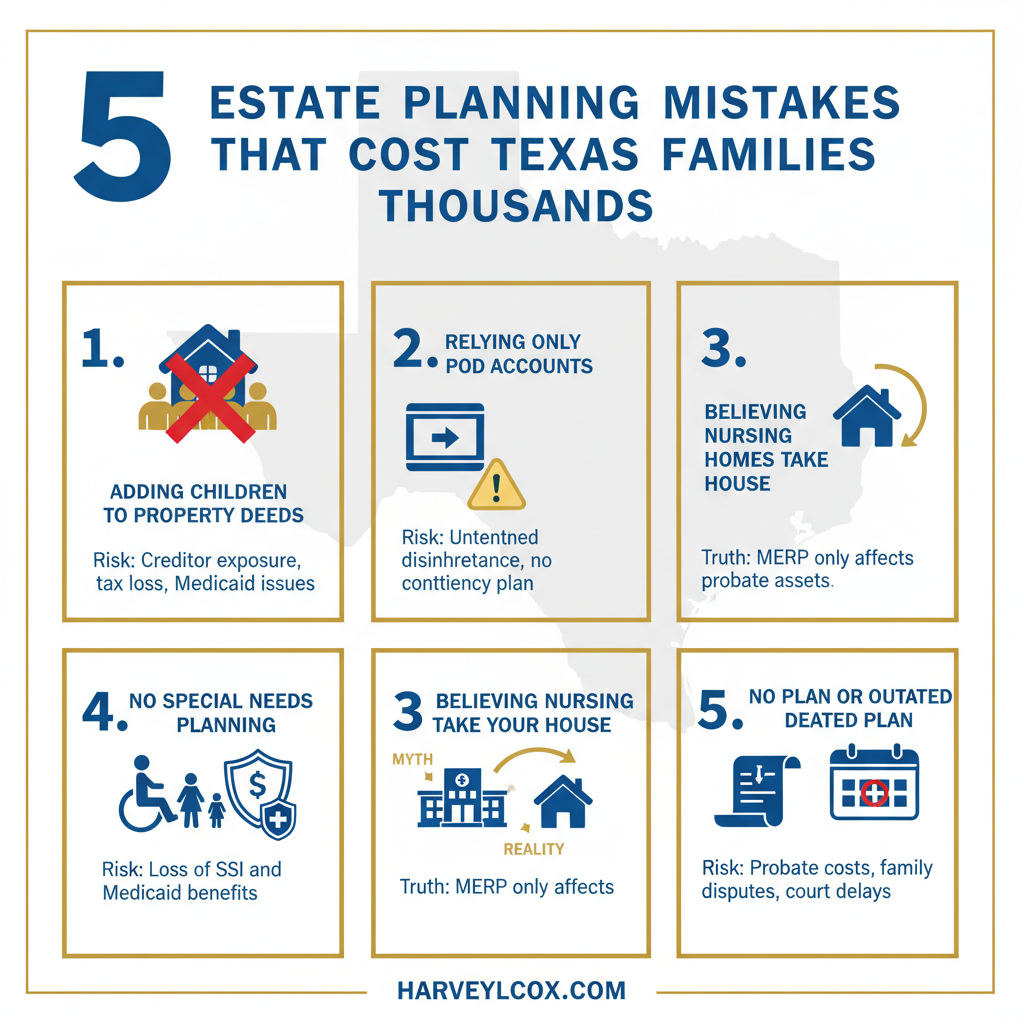

Mistake #1: Adding Your Children’s Names to Your Property Deed

This is perhaps the most common—and most expensive—mistake I see Texas families make.

Why people do it: Parents think adding a child to their deed will help avoid probate and make things “simpler” when they pass away.

The reality: This strategy backfires in multiple ways:

- Gift tax implications – You may trigger federal gift tax reporting requirements

- Loss of step-up in basis – Your child loses the valuable tax benefit that eliminates capital gains tax on inherited property

- Creditor exposure – Your property becomes vulnerable to your child’s lawsuits, divorces, and creditors

- Medicaid complications – This transfer can disqualify you from Medicaid benefits for long-term care

Example: A Waco couple added their son to the deed of their $300,000 home. Years later, the son went through a divorce. His ex-wife’s attorney argued she was entitled to a portion of the home’s value. What seemed like simple planning turned into a legal nightmare.

Better solution: Use a Transfer on Death Deed or place the property in a revocable living trust. Both avoid probate without the risks of joint ownership.

Mistake #2: Relying Solely on Payable-on-Death (POD) Designations

Bank accounts with POD designations seem like an easy estate planning solution, but they create serious problems.

The problems with POD-only planning:

- Unintended disinheritance – POD designations override your will, potentially cutting out other family members you intended to provide for

- Minor beneficiary complications – If a minor inherits through POD, the court must appoint a guardian to manage the funds until age 18

- No contingency planning – If your named beneficiary dies before you and you forget to update the designation, the account goes through probate anyway

- Unequal distributions – Multiple accounts with different POD beneficiaries often result in unintended unequal inheritances

Better solution: Coordinate POD designations with a comprehensive estate plan that includes contingency planning, especially if you have minor children or want to protect beneficiaries from creditors.

Mistake #3: Believing “The Nursing Home Will Take My House”

This misconception causes unnecessary panic and leads families to make hasty, damaging decisions.

The truth about Texas Medicaid and your home:

Nursing homes cannot “take” your house. However, the Texas Medicaid Estate Recovery Program (MERP) can place a claim against your estate after death to recover long-term care costs—but only against assets that go through probate.

Key protection: Assets in a properly funded revocable living trust do NOT go through probate and are therefore protected from MERP claims.

What this means: You can protect your family home from Medicaid estate recovery without giving up ownership or control during your lifetime. You don’t need to transfer the deed to your children (see Mistake #1) or engage in complicated Medicaid planning years in advance.

Better solution: Establish a revocable living trust and transfer your real estate into it. You maintain complete control during your lifetime, avoid probate, and protect the property from MERP.

Mistake #4: Failing to Plan for Special Needs Family Members

If you have a child or grandchild receiving government benefits like SSI or Medicaid, a direct inheritance can disqualify them from these critical programs.

The problem: Most people don’t realize that leaving money directly to a disabled beneficiary—even with the best intentions—can:

- Disqualify them from Supplemental Security Income (SSI)

- Eliminate their Medicaid coverage

- Force them to spend down the inheritance before benefits resume

The solution: Special Needs Trusts

A properly drafted special needs trust (also called a supplemental needs trust) allows you to provide for your loved one without jeopardizing their government benefits. The trust can pay for:

- Medical and dental care not covered by Medicaid

- Education and training

- Recreation and entertainment

- Personal care attendants

- Transportation

Important: Most families don’t resist setting up special needs trusts once they understand the benefits. The key is knowing you need one in the first place.

Mistake #5: Not Having a Plan at All (or Having an Outdated One)

The “do nothing” approach is actually an estate plan—it’s just the worst possible plan. In Texas, if you die without a will or trust:

- Your estate goes through probate (costly and time-consuming)

- Texas intestacy laws determine who inherits (not your wishes)

- Your family may face months of court proceedings and legal fees

- Minor children’s inheritances require court-supervised guardianships

When to update your estate plan:

Even if you have documents, they may be outdated if:

- You created them more than 5 years ago

- You’ve had major life changes (marriage, divorce, births, deaths)

- You’ve acquired significant new assets

- You’ve moved to Texas from another state

- Beneficiaries’ circumstances have changed (divorce, disability, financial problems)

Common updates needed:

- Adding or removing beneficiaries (most common in the first year)

- Changing beneficiary designations (often to disinherit or re-include someone)

- Updating asset protection strategies as your net worth grows

- Adding special needs provisions for family members

The Real Cost of Estate Planning Mistakes

These mistakes don’t just cost money—they cost families:

- Time: Probate in Texas typically takes 10-18 months

- Privacy: Probate is public record; anyone can see what you owned and who inherited

- Family harmony: Unclear plans lead to disputes and damaged relationships

- Asset protection: Improperly titled assets remain vulnerable to lawsuits and creditors

- Tax efficiency: Poor planning can result in unnecessary capital gains and estate taxes

How to Avoid These Mistakes: The Family Legacy Planning Approach

At the Law Office of Harvey L. Cox, we take a comprehensive approach to estate planning that protects your family from all five of these common mistakes—and more.

Our Family Legacy Planning focuses on protecting your assets from:

- Probate delays and expenses

- Lawsuits and creditor claims

- Unnecessary taxes

- Stock market volatility

- Long-term care costs

- Medicaid estate recovery

Our estate planning packages include:

- Family Plan (\$2,995): Comprehensive will-based planning with powers of attorney, medical directives, and Transfer on Death Deed

- Trust Plan (\$3,995): Revocable living trust with asset protection features, contingency trusts for minor beneficiaries, and spendthrift protections

Both plans include proper asset titling guidance and funding assistance to ensure your plan actually works when your family needs it.

Take the Next Step

Don’t let these common mistakes put your family’s financial security at risk. Whether you’re just starting to think about estate planning or need to update an outdated plan, we can help.

Schedule your consultation today:

- Waco office: Serving Central Texas families for over 20 years

- Round Rock office: Convenient location for Austin-area residents

Call us or visit harveylcox.com to get started.

You can also attend one of our free on-demand estate planning webinars to learn more about protecting your family’s legacy.

About the Author

Harvey L. Cox has been practicing estate planning and asset protection law in Texas since 1990. He holds a law degree from the University of Houston Law Center and is a member of the Texas Bar College. Harvey teaches estate planning courses at McLennan Community College and focuses exclusively on helping Texas families protect their assets and loved ones.