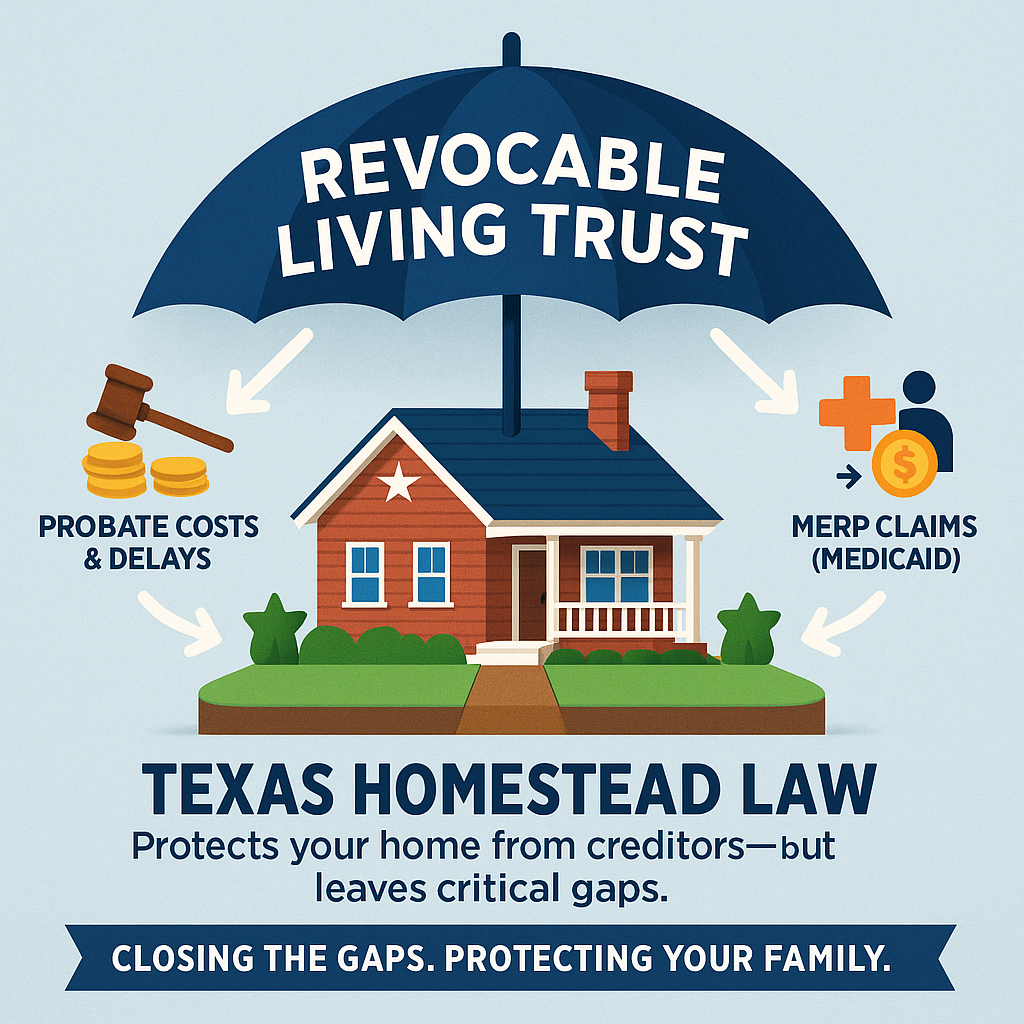

The Texas Homestead Advantage—And Its Hidden Gap

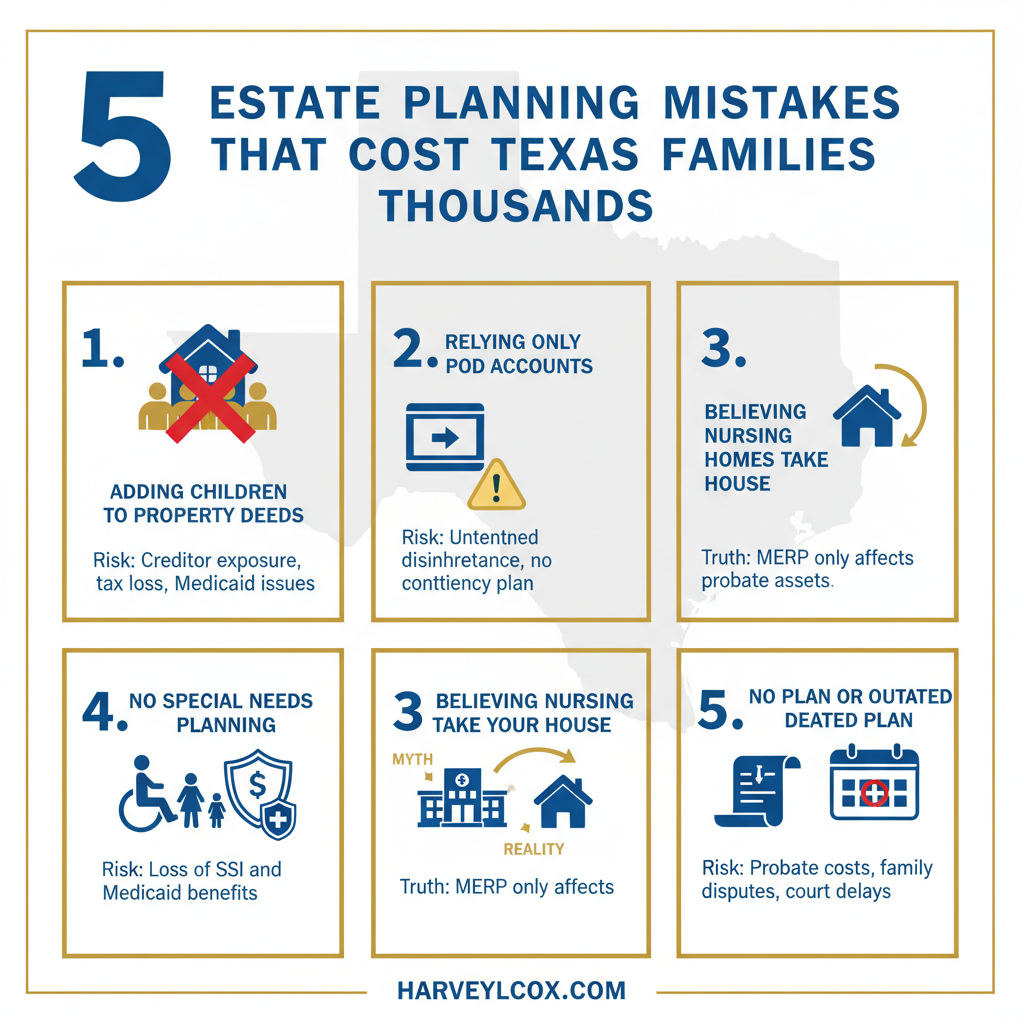

Your Home Is Already Protected. But Is Your Family? If you own a home in Texas, you already have one of the strongest asset protection tools in the country working for you—unlimited homestead protection. Unlike most states that cap homestead exemptions at $100,000 or $500,000, Texas law protects your primary residence from creditors and lawsuits … Read more