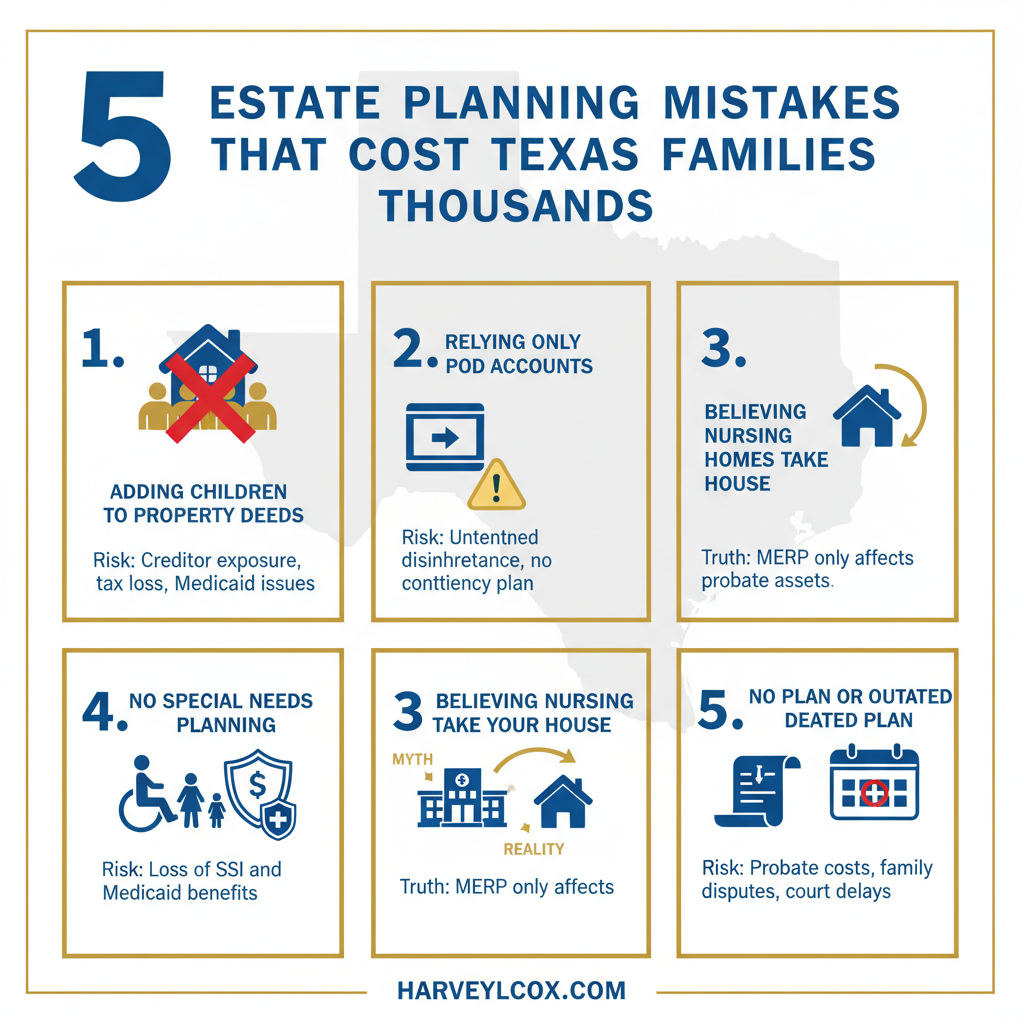

5 Estate Planning Mistakes That Could Cost Your Texas Family Thousands

When it comes to protecting your family’s future, even small estate planning mistakes can have devastating financial consequences. After more than 30 years of practicing estate planning law in Texas, I’ve seen families lose tens of thousands of dollars—and irreplaceable peace of mind—due to easily preventable errors.Whether you’re in Waco, Round Rock, or anywhere in … Read more