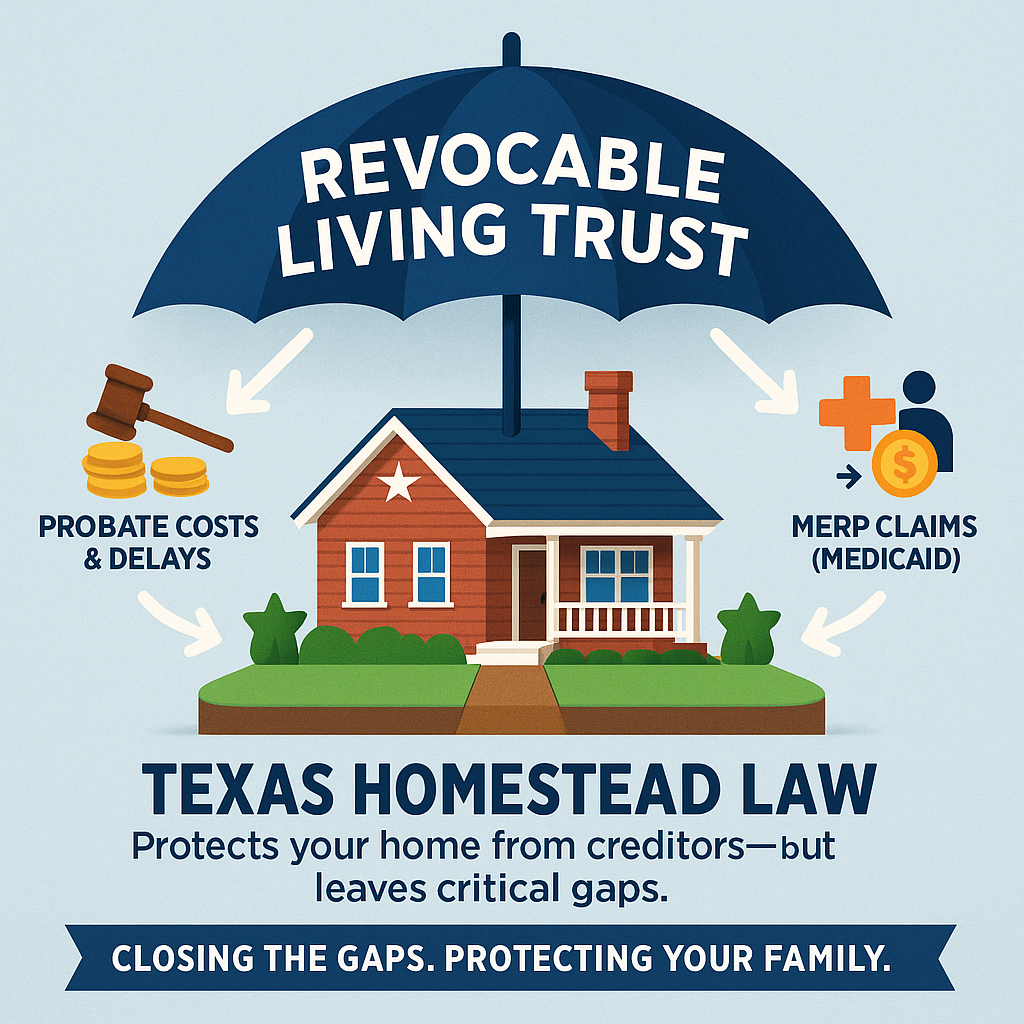

Your Home Is Already Protected. But Is Your Family?

If you own a home in Texas, you already have one of the strongest asset protection tools in the country working for you—unlimited homestead protection. Unlike most states that cap homestead exemptions at $100,000 or $500,000, Texas law protects your primary residence from creditors and lawsuits regardless of its value.

That $450,000 home in Waco? Protected.That $1.2 million property in Austin? Protected.Even that multi-acre ranch homestead? Protected.

This is powerful protection. And if you’re reading this, you probably already know it.

But here’s what most Texas homeowners don’t realize: homestead protection ends the moment you do.

The Three Gaps Homestead Protection Can’t Fill

Your homestead shields you from creditors and lawsuits during your lifetime. But it does absolutely nothing to protect your family from three critical threats after you’re gone—or if you become incapacitated.

Gap #1: Medicaid Estate Recovery Program (MERP) Claims

Texas homestead law protects your home from creditors. It does not protect it from the state.

If you receive Medicaid benefits for long-term care (nursing home, assisted living, or in-home care), the state can—and will—file a claim against your estate to recover what it paid. This is called the Medicaid Estate Recovery Program (MERP).

Real scenario:A Waco couple owns a $450,000 home. The husband enters a nursing home and receives $120,000 in Medicaid benefits over three years. After his death, the state files a MERP claim for $120,000 against the estate. The home must go through probate, and the family faces a choice: pay the claim or lose the home.

Even if the family pays, they’re still exposed to probate costs, delays, and legal fees—often $10,000 to $30,000 or more.

The homestead protected them during life. But it couldn’t protect their heirs.

Gap #2: Probate Costs and Delays

Homestead protection doesn’t avoid probate. In fact, your home is often the largest asset that gets stuck in probate.

Probate in Texas typically costs 3–5% of the estate value and takes 6–12 months (or longer if contested). For a $450,000 home, that’s $13,500 to $22,500 in costs—plus months of uncertainty, court filings, and family stress.

And if you own property in multiple counties? You’ll face ancillary probate in each one, multiplying the cost and delay.

Your homestead is protected from creditors. But not from probate.

Gap #3: Incapacity Management

Homestead protection only works if you’re alive and competent. If you become incapacitated due to stroke, dementia, or injury, no one can manage your home without court intervention—unless you’ve planned ahead.

Without a trust or durable power of attorney, your family will need to petition the court for guardianship. This process is expensive, public, and time-consuming. And even then, the court—not your family—controls major decisions about your property.

Your homestead protects you from lawsuits. But not from incapacity.

The Solution: A Revocable Living Trust

A Revocable Living Trust preserves all the benefits of Texas homestead protection during your lifetime—while closing the three gaps that leave your family exposed.

How It Works

- During your life: You retain full control of your home. You can sell it, refinance it, or live in it. Homestead protection remains fully intact.

- If you become incapacitated: Your successor trustee manages the property without court intervention. No guardianship needed.

- After your death: The home transfers directly to your heirs—outside of probate, avoiding MERP claims (when structured properly), and without court costs or delays.

Why This Matters for Texas Families

You’ve already taken the first step by owning a homestead in Texas. You’re protected from creditors and lawsuits during your lifetime.

But if you want to protect your family from probate costs, MERP claims, and incapacity chaos, a trust is the only tool that closes the gap.

Real Numbers: What’s at Stake?

Let’s return to that Waco couple with a $450,000 home.

Without a trust:

- Probate costs: $13,500–$22,500

- MERP claim (if Medicaid used): $80,000–$120,000+

- Legal fees, court delays, family stress: Priceless (and painful)

Total exposure: $93,500 to $142,500+

With a trust:

- Probate costs: $0

- MERP exposure: Significantly reduced or eliminated (with proper planning)

- Incapacity management: Seamless, private, no court involvement

Total cost to set up trust: $3,995 (one-time investment)

Common Questions

Q: Will I lose my homestead exemption if I transfer my home to a trust?

A: No. Texas law specifically allows homestead property to be transferred to a revocable living trust without losing the exemption.

Q: Can I still refinance or sell my home if it’s in a trust?

A: Yes. You retain full control as trustee. You can sell, refinance, or make any changes just as you would if the home were in your name alone.

Q: Does a trust really protect against MERP claims?

A: When structured properly, yes. A trust can shield assets from MERP recovery by ensuring the home doesn’t pass through probate (where MERP claims are filed). This requires careful planning and proper trust funding.

What to Do Next

If you own a home in Texas and want to protect your family from probate, MERP claims, and incapacity chaos, a Revocable Living Trust is the missing piece.

Your homestead is already doing its job. Now it’s time to close the gap.

Schedule a consultation to discuss how a trust-based estate plan can preserve your homestead protection while safeguarding your family’s future.

Law Office of Harvey L. Cox

Waco, Texas

Protecting Texas families through comprehensive estate planning and asset protection strategies.